This is a summary of the National Conference of State Legislatures* report of current state minimum wages. The federal minimum wage is $7.25 per hour effective July 24, 2009. The federal minimum wage provisions are contained in the Fair Labor Standards Act (FLSA). Many states also have minimum wage laws. Where federal and state law have different minimum wage rates, the higher standard applies.

A

- chevron_right Alabama

Employers subject to the Fair Labor Standards Act must pay the current Federal minimum wage of $7.25 per hour.

Minimum Wage Updated January 2026

Note: Federal minimum wage applies.

- chevron_right Alaska

Minimum Wage Updated January 2026

$13.00Future Enacted Increases:

On July 1, 2026, Alaska’s minimum wage will rise to $14.00 per hour under state law.

- chevron_right American Samoa

The Fair Labor Standards Act (FLSA) applies generally to employment within American Samoa as it does to employment within the United States. The Fair Minimum Wage Act of 2007, as most recently amended by H.R. 2617 (Public Law 114-61), sets industry-specific minimum wage rates within American Samoa and provides that additional increases in those minimum wage rates of $0.40 per hour will occur every three years on September 30, until all of the minimum wage rates equal the federal minimum wage. American Samoa’s industry-specific minimum wage rates were most recently increased by $0.40 each on September 30, 2018, and are scheduled to increase again in 2021, 2024, 2027, etc. American Samoa’s minimum wage rates are set for particular industries, not for an employee’s particular occupation. The rates are minimum rates; an employer may choose to pay an employee at a rate higher than the industry-specific rate.

- chevron_right Arizona

Minimum Wage Updated January 2026

$15.15 - chevron_right Arkansas

Applicable to employers of 4 or more employees

Employers must pay the Arkansas minimum wage when it exceeds the federal minimum wage.

Minimum Wage Updated January 2026

$11.00

C

- chevron_right California

Fast-food workers are subject to a separate minimum wage of $20.00 per hour. This applies to fast-food chains with 60 or more establishments nationwide, including franchises.

Minimum Wage Updated January 2026

$16.90 - chevron_right Colorado

Minimum Wage Updated January 2026

Colorado (if no local minimum applies) $15.16

Denver City/County $19.29

City of Edgewater $18.17

Boulder County (city & unincorporated areas) $16.82 - chevron_right Connecticut

Minimum Wage Updated January 2026

$16.94

D

- chevron_right Delaware

Minimum Wage Updated January 2026

$15.00 - chevron_right District of Columbia

The minimum wage is adjusted annually on July 1 based on a set formula.

Minimum Wage Updated January 2026

$17.95

F

- chevron_right Florida

Minimum Wage Updated January 2026

$14.00Future Enacted Increases:

The minimum wage is adjusted annually based on a set formula. The Florida minimum wage is scheduled to increase by $1.00 every September 30th until reaching $15.00 on September 30, 2026.

G

- chevron_right Georgia

Employers of six or more employees must pay the state minimum wage. Employees covered by the federal Fair Labor Standards Act myst be paid the federal minimum wage of $7.25 per hour.

Minimum Wage Updated January 2026

$5.15 - chevron_right Guam

The minimum wage applies to all covered employees. Employees subject to the federal Fair Labor Standards Act (FLSA) must be paid at least the federal minimum wage of $7.25 per hour.

Minimum Wage Updated January 2026

$10.50

H

- chevron_right Hawaii

Employment covered by the Fair Labor Standards Act is also subject to Hawaii law, and the higher wage rate applies.

Minimum Wage Updated January 2026

$16.00

I

- chevron_right Idaho

Minimum Wage Updated January 2026

$7.25 - chevron_right Illinois

Minimum Wage Updated January 2026

$15.00 - chevron_right Indiana

Employers subject to the Fair Labor Standards Act must pay the current federal minimum wage of $7.25 per hour.

Minimum Wage Updated January 2026

$7.25 - chevron_right Iowa

Iowa’s minimum wage defaults to the federal minimum wage when the federal rate is higher.

Minimum Wage Updated January 2026

$7.25

K

- chevron_right Kansas

Employers subject to the Fair Labor Standards Act must pay the current federal minimum wage of $7.25 per hour.

Minimum Wage Updated January 2026

None - chevron_right Kentucky

Kentucky’s minimum wage defaults to the federal minimum wage, which currently applies.

Minimum Wage Updated January 2026

$7.25

L

- chevron_right Louisiana

Employers subject to the Fair Labor Standards Act must pay the current federal minimum wage of $7.25 per hour.

Minimum Wage Updated January 2026

None

M

- chevron_right Maine

Maine adopts the federal minimum wage when it exceeds the state minimum.

The minimum wage is adjusted annually based on a statutory formula.

Minimum Wage Updated January 2026

$15.10 - chevron_right Maryland

Employees under 18 years may be paid 85% of the minimum hourly wage rate.

Minimum Wage Updated January 2026

$15.00 - chevron_right Massachusetts

In no case shall the Massachusetts minimum wage rate be less than $0.50 higher than the effective federal minimum rate.

Minimum Wage Updated January 2026

$15.00 - chevron_right Michigan

Minimum Wage Updated January 2026

$13.73 - chevron_right Minnesota

Minimum Wage Updated January 2026

$11.41 - chevron_right Mississippi

Employers subject to the Fair Labor Standards Act must pay the current federal minimum wage of $7.25 per hour.

Minimum Wage Updated January 2026

None - chevron_right Missouri

Missouri law exempts certain federally covered employment and retail or service businesses with gross annual sales under $500,000.

The minimum wage is adjusted annually based on a statutory formula.

Minimum Wage Updated January 2026

$15.00 - chevron_right Montana

A business not covered by the FLSA with gross annual sales of $110,000 or less may pay $4.00 per hour; however, employees individually covered by the FLSA must be paid the greater of the federal or Montana minimum wage.

The minimum wage is adjusted annually based on a statutory formula.

Minimum Wage Updated January 2026

$10.85

N

- chevron_right Nebraska

Applicable to employers of 4 or more employees

Minimum Wage Updated January 2026

$15.00 - chevron_right Nevada

Minimum Wage Updated January 2026

$12.00 - chevron_right New Hampshire

Employers subject to the Fair Labor Standards Act must pay the current federal minimum wage of $7.25 per hour.

Minimum Wage Updated January 2026

None - chevron_right New Jersey

Under the law, the minimum wage for employees of seasonal and small employers continues to increase gradually through 2028; the rate will be $15.23 on January 1, 2026.

Minimum Wage Updated January 2026

$15.92 - chevron_right New Mexico

Minimum Wage Updated January 2026

$12.00 - chevron_right New York

New York’s minimum wage law sets different rates by region.

Minimum Wage Updated January 2026

$16.00$16.50 (New York City, Nassau County, Suffolk County, & Westchester County)

- chevron_right North Carolina

Employers subject to the Fair Labor Standards Act must pay the current federal minimum wage of $7.25 per hour.

Minimum Wage Updated January 2026

- chevron_right North Dakota

Employers subject to the Fair Labor Standards Act must pay the current federal minimum wage of $7.25 per hour.

Minimum Wage Updated January 2026

O

- chevron_right Ohio

*For employers with annual gross receipts at or below the state threshold and for employees ages 14–15, the minimum wage is $7.25 per hour.

Minimum Wage Updated January 2026

$11.00/$7.25* - chevron_right Oklahoma

Employers subject to the Fair Labor Standards Act must pay the current federal minimum wage of $7.25 per hour.

Minimum Wage Updated January 2026

- chevron_right Oregon

Oregon’s minimum wage varies by region under state law.

Minimum wages are adjusted annually for cost-of-living changes in each region.

See Minimum wage increase schedule.

Minimum Wage Updated January 2026

$15.05

$16.30 (Portland Metro Area)

$14.05 (Non-Urban Counties)

P

- chevron_right Pennsylvania

Pennsylvania’s minimum wage defaults to the federal rate when higher.

Minimum Wage Updated January 2026

$7.25 - chevron_right Puerto Rico

Puerto Rico has its own minimum wage law that is higher than the federal minimum wage.

Minimum Wage Updated January 2026

$10.50

R

- chevron_right Rhode Island

Minimum Wage Updated January 2026

$16.00

S

- chevron_right South Carolina

Employers subject to the Fair Labor Standards Act must pay the current federal minimum wage of $7.25 per hour.

Minimum Wage Updated January 2026

- chevron_right South Dakota

The minimum wage is adjusted annually based on a set formula.

Minimum Wage Updated January 2026

$11.85

T

- chevron_right Tennessee

Employers subject to the Fair Labor Standards Act must pay the current Federal minimum wage of $7.25 per hour.

Minimum Wage Updated January 2026

- chevron_right Texas

Employers subject to the Fair Labor Standards Act must pay the current federal minimum wage of $7.25 per hour.

Minimum Wage Updated January 2026

U

- chevron_right Utah

Employers subject to the Fair Labor Standards Act must pay the current federal minimum wage of $7.25 per hour.

Minimum Wage Updated January 2026

V

- chevron_right Vermont

Applicable to employers of two or more employees.

If the federal minimum wage is higher than the Vermont minimum wage, the federal minimum wage applies.

The minimum wage is adjusted annually based on a set formula.

Minimum Wage Updated January 2026

$14.42 - chevron_right Virgin Islands

Minimum Wage Updated January 2026

$10.50 - chevron_right Virginia

The minimum wage is adjusted annually based on a set formula.

Minimum Wage Updated January 2026

$12.77

W

- chevron_right Washington

The minimum wage is adjusted annually based on a set formula.

Minimum Wage Updated January 2026

$17.13 - chevron_right West Virginia

Applicable to employers of 6 or more employees at one location.

Minimum Wage Updated January 2026

$8.75 - chevron_right Wisconsin

Employers subject to the Fair Labor Standards Act must pay the current federal minimum wage of $7.25 per hour.

Minimum Wage Updated January 2026

- chevron_right Wyoming

*Federal minimum wage applies ($7.25). State rate: $5.15 where federal law does not apply.

Minimum Wage Updated January 2026

$5.15/$7.25*

Other Exceptions: Missouri, Oklahoma, Texas, Puerto Rico, Utah, and Virginia exclude from coverage any employment that is subject to the Federal Fair Labor Standards Act. Hawaii, Kansas, and Michigan exclude from coverage any employment that is subject to the Federal Fair Labor Standards Act, if the State wage is higher than the Federal wage. Georgia excludes from coverage any employment that is subject to the Federal Fair Labor Standards Act when the Federal rate is greater than the State rate.

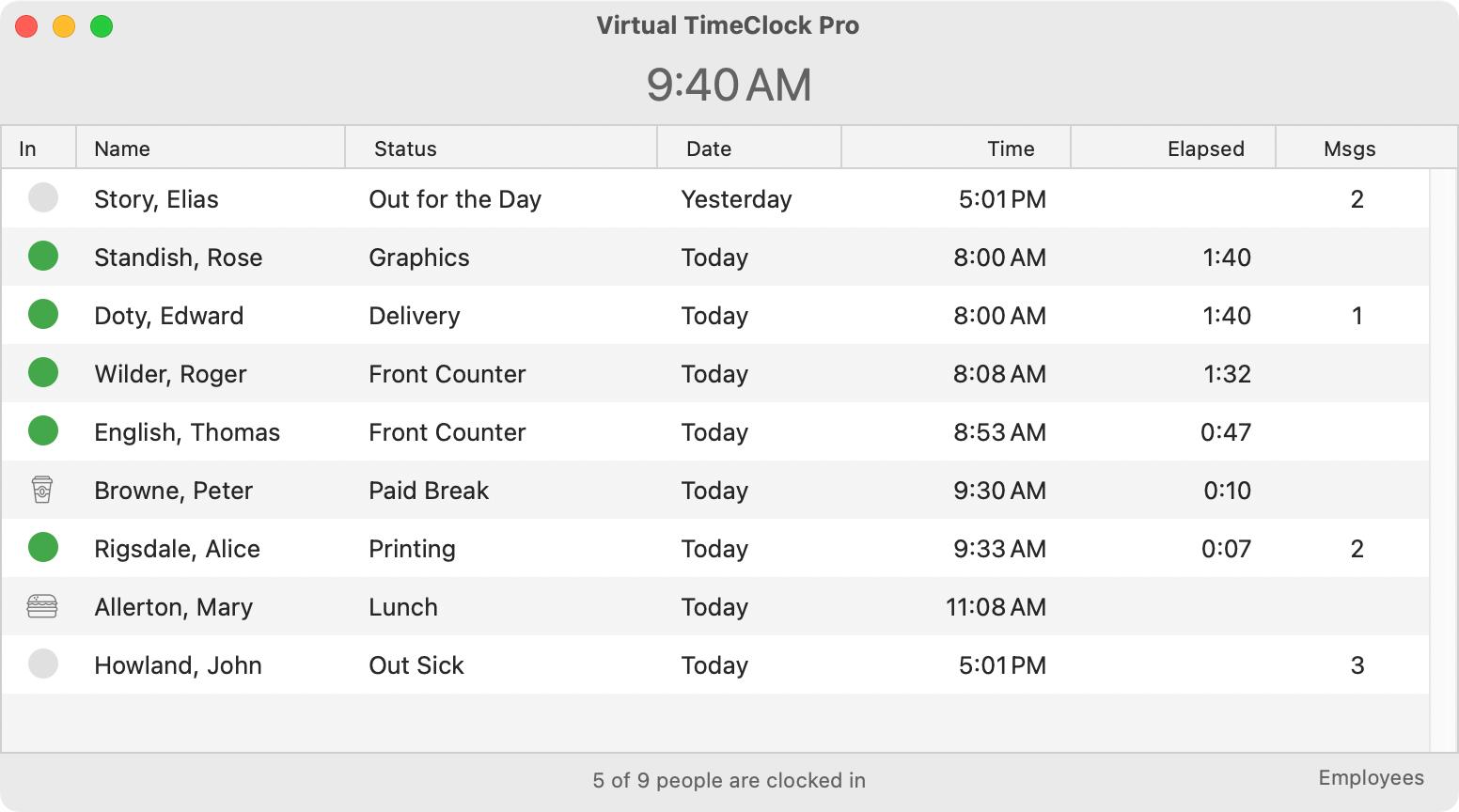

Accurate Hourly Tracking for Proper Pay

Virtual TimeClock

Easy employee time clock software

- Track & total hours automatically

- Control breaks & overtime

- Manage vacations & time off

- Affordable one-time purchase

* The National Conference of State Legislatures has additional information on state minimum wages.

* The The Economic Policy Institute Minimum Wage Tracker also has additional information on state minimum wages.

Redcort Software Inc. assumes no liability and makes no warranties on or for the information contained on these pages. The information presented is intended for reference only and is neither tax nor legal advice. Consult a professional tax, legal or other advisor to verify this information and determine if and/or how it may apply to your particular situation.